Global air cargo volumes continued to show solid momentum in November, reinforcing a steady growth pattern heading into the final quarter of the year. According to the latest WorldACD market data, worldwide air cargo tonnages in November increased by 5% year-on-year, an improvement on the 4% growth recorded in both September and October. This confirms consistent demand across major trade lanes and signals a resilient air cargo market as the year draws to a close.

Regional Growth Patterns

Growth was driven primarily by shipments originating from:

- Middle East & South Asia (MESA): +11% YoY

- Asia Pacific: +8% YoY

- Central & South America (CSA): +6% YoY

Month-on-month comparisons also showed positive movement, with average weekly volumes in November rising 3% compared to October. Asia Pacific (+5%) and CSA (+6%) led this increase, while Africa and MESA also recorded modest gains. Slight declines were observed from North America and Europe, reflecting normal market fluctuations.

Shifting Trade Lanes: Southeast Asia to the US Gains Momentum

A closer look at Asia Pacific exports reveals a clear divergence between shipments destined for the United States and those bound for Europe.

Air cargo volumes from Asia Pacific to the US rose by approximately 6% year-on-year in November. However, this growth was overwhelmingly driven by Southeast Asia, where tonnages surged by around 42% YoY. In contrast, shipments from China and Hong Kong to the US declined sharply.

Combined volumes from China and Hong Kong to the US fell by 8% YoY, with Hong Kong-to-US shipments experiencing the steepest drop. This shift reflects changing sourcing strategies among US importers, driven by tariff pressures and regulatory changes that have altered traditional China–US trade flows.

Europe Tells a Different Story

The picture looks markedly different when examining Asia-to-Europe air cargo flows.

Shipments from China and Hong Kong to Europe increased by 8% year-on-year in November, directly contrasting with the declines seen on US-bound lanes. Exports from Hong Kong to Europe rose by 14%, while China-to-Europe volumes grew by more than 5%.

Year-to-date figures reinforce this trend. For the first eleven months of the year:

- China & Hong Kong volumes to the US are down 7%

- China & Hong Kong volumes to Europe are up 8%

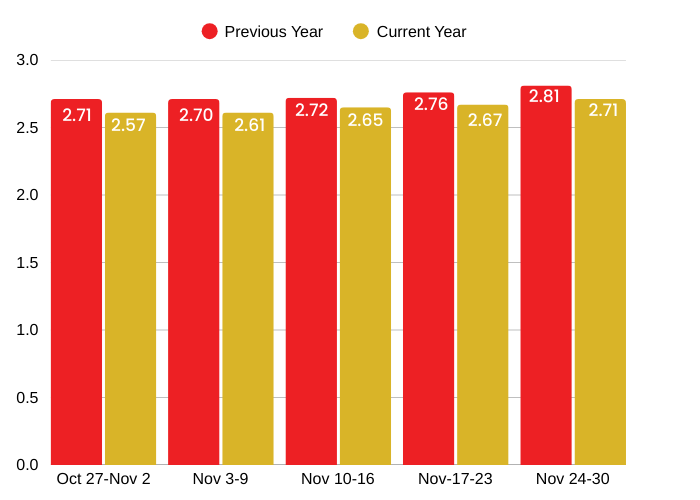

Rates Continue an Upward Trend

On the pricing side, average worldwide air cargo rates rose again in November, reaching US$2.65 per kilo, a 7% increase month-on-month. The strongest pricing gains were recorded from Central & South America and Asia Pacific origins.

Spot rates followed a similar pattern, climbing to an average of US$2.87 per kilo, driven by increased activity across several key regions. However, despite recent increases, global spot rates remain below last year’s elevated levels, particularly from Middle East & South Asia origins.

On a year-to-date basis, average global rates remain broadly stable compared to last year, indicating a market that is firm but not overheated.

Late November Snapshot

In the final full week of November, global volumes dipped slightly, largely due to reduced activity from North America around the Thanksgiving holiday. Excluding this effect, volumes across other regions were largely stable, with Asia Pacific shipments holding steady.

Rates continued their gradual upward movement during the week, consistent with typical late-year market behavior.

Key Takeaways

The November data highlights a market shaped less by overall demand shifts and more by structural changes in sourcing, trade lanes, and regional strategies.

For shippers, this reinforces the importance of:

- Diversified sourcing strategies

- Flexible routing options

- Real-time visibility into capacity and pricing