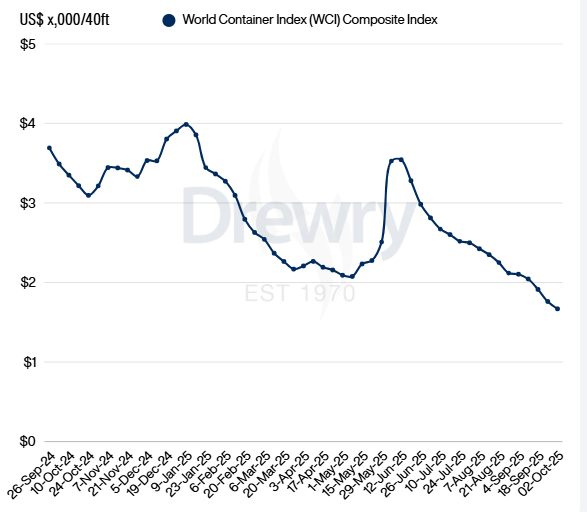

Global container rates are plunging in October 2025 due to slowing demand, overcapacity, and weak trade volumes, with Drewry's World Container Index showing significant declines for the 16th consecutive week. This trend is driven by consumer concerns, tariffs on US trade, and carriers reducing capacity through blank sailings to align with reduced demand following China's Golden Week holiday, leading to expectations of continued rate contraction.

Image credit: Drewry

Key Factors Contributing to the Plunge

- Slowing Demand: Global demand is weakening, with forecasts for muted outlooks through the year's end.

- Overcapacity: There is an abundant supply of vessels, contributing to a bearish supply-demand balance.

- China's Golden Week: The holiday caused factory shutdowns, leading to temporary disruptions and a predicted dip in spot rates in the following weeks.

- Tariff-Driven Trade Shifts: U.S.-bound trade lanes are in sharp decline due to tariff hikes, while other trade routes show surprising growth, creating market divergence.

Industry Response

- Blank Sailings: Carriers are increasing blank sailings to reduce capacity and manage the surplus of vessels, according to FreightWaves and Drewry.

- Lower Spot Rates: The Shanghai-Los Angeles route has seen spot rates decrease significantly, reaching levels not seen since December 2023.

Outlook

- Continued Contraction: Drewry's Container Forecaster anticipates that the weakening supply-demand balance will continue to cause spot rates to contract in the coming quarters.

- Impact on Contracts: The worsening spot rate environment poses risks to upcoming annual contract negotiations, as spot indexes typically signal future contract rate trends.

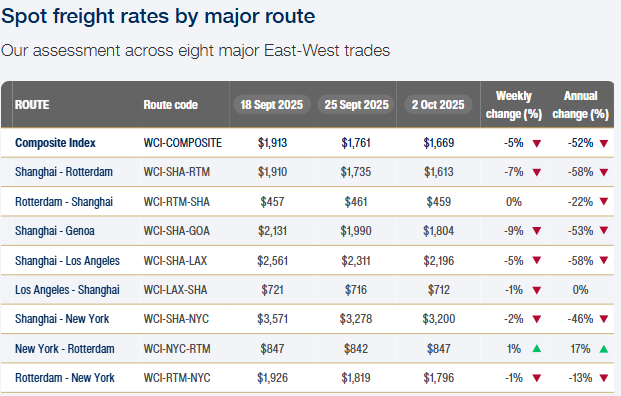

Detailed Assessment as at Thursday, 02 Oct 2025

- The Drewry World Container Index (WCI) fell 5% to $1,669 per 40ft container, marking the 16th consecutive weekly decline and reaching the lowest level since January 2024.

- Spot rates from Shanghai to Los Angeles decreased 5% to $2,196 per 40ft container, while those from Shanghai to New York decreased 2% to $3,200 per 40ft container.

- Asia–Europe spot rates fell this week again, reducing for the 10th consecutive week— declined 7% ($1,613 per 40ft container) on Shanghai–Rotterdam and 9% ($1,804 per 40ft container) on Shanghai–Genoa.

- Carriers are increasing blank sailings and reducing capacity to align with slowing demand ahead of China’s Golden Week holiday when factories will be shut for eight days from 1 October. As a result, East–West spot rates are expected to decrease in the coming weeks.

- Drewry’s Container Forecaster expects the supply-demand balance to weaken in the next few quarters, which will cause spot rates to contract.

Key Takeaway

At Freightways, we stay in the know — constantly monitoring global logistics trends to ensure we adapt, optimize, and deliver on time. Our expertise helps clients navigate the constantly changing market and logistics trends, and keep supply chains running smoothly. Contact us to learn how we can help you stay ahead in an ever-evolving logistics landscape.